義大利國家電力公司

義大利國家電力公司

義大利國家電力公司(ENEL),義大利電力工業早期主要由私營企業經營,1962年後根據"公共電業國有法",政府接管了全國的私營電力公司,組建了國有的義大利國家電力公司(ENEL),對發、輸、配電採用垂直一體化管理體制,是義大利最大的發電供電商。義大利國家電力公司目前在義大利全國的客戶數量有3千萬戶,占整個義大利的87%。

2018年7月19日,《財富徠》世界500強排行榜發布,義大利國家電力公司位列83位。 2018年12月,世界品牌實驗室發布《2018世界品牌500強》榜單,義大利國家電力排名第448。2021年8月2日,位列2021年《財富》世界500強排行榜第118位。

ENEL 義大利國家電力公司

(圖)義大利國家電力公司

ENEL是全球第三大電力公司,是義大利國內最大的國有公共事業企業。在《商業周刊》評選的 2003 年度全球股票市值最大的 1000 家公司排行榜中, Enel Spa 名列第 77 位。

義大利國家電力公司是由21家電力、電信、網路、檢測企業組成的集團公司,是義大利最大的電力供應商和第二大天然氣經銷商、供應商。1999年,義大利國家電力公司在米蘭和紐約股票交易所同時上市,市值400多億歐元。該公司已在北京設立了辦事處。

義大利國家電力公司 ENEL 是全球第三大電力公司,是 義大利國內最大的國有公共事業企業。與美國、法國、羅馬尼亞等國家有著密切的合作。

Enel Spa 是一家業績優良的義大利國有控股公司, 2003 年營業收入超過 310 億歐元,凈利潤達 25 億歐元。它是義大利第一大電力供應商,在國內擁有超過 4500 萬 kW 的總裝機容量,約 3000 萬用電客戶,它還是義大利第二大天然氣銷售供應商,為 190 萬用戶提供天然氣。此外,它還是全球再生能源利用方面的前導企業,在西班牙、北美和拉丁美洲等地區有廣泛影響。 Enel Spa 在資本市場也佔據重要地位。 1999 年 11 月 Enel Spa 分別在米蘭和紐約證券交易所首次公開發行了價值 165.5 億歐元的股票,占國有股權的 32% ,是迄今歐洲規模最大、全球排名第二的 IPO ,股東人數達到 250 萬。去年 10 月,義大利政府又通過摩根斯坦利成功拋售了 6.6% 的國有股權,獲得 21.7 億歐元的收入。

義大利電力工業早期主要由私營企業經營, 1962 年後根據“公共電業國有法”,政府接管了全國的私營電力公司,組建了國有的義大利國家電力公司( ENEL ),對發、輸、配電採用垂直一體化管理體制,是義大利最大的發電供電商。

1992 年, ENEL 成為聯合股份公司,到 1999 年 11 月, ENEL 售出了 34.5 %的股份並在米蘭和紐約股票交易所上市。當時約有 300 萬人買進了該股,使之成為義大利持有最為廣泛的股票。 1999 年底, ENEL 抽資脫離 3 個獨立的發電公司,這 3 個公司分別是:最大的 Eruogen 公司,位居第 2 的 Elettrogen 公司和 Interpower 公司,他們的總發電容量為 1500 萬 kW 。

2000 年 5 月, ENEL 將它的 26 座水電站賣給了一家合資公司,該公司將負責這些電站以及相關輸變電網的運行。 2000 年 4 月義大利國家電力調度中心( GRTN )正式開始運行,財政部擁有其全部股份。 GRTN 受工業部和其他政府部門領導,與電網的擁有者是合同關係。 GRTN 的主要職責是管理輸電和調度;根據安全、可靠性及經濟標準明確網路的檢修和發展計劃;與電網擁有者簽定合同。 GRTN 下又成立了 2 個公司,即市場運行者( MO )公司和單一購買者( SB )公司。 GRTN 對這 2 個公司擁有 100% 的股份。

2003 年 10 月,為提高機構投資者持有量,義大利經濟部作價 22 億歐元將該公司 6.6% 的股權出售給摩根士丹利

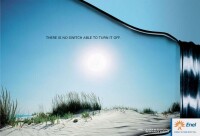

(圖)ENEL的廣告

2004 年 10 月, Enel Spa 國有股權的再次出售,將對義大利的財政狀況、電力改革和資本市場產生重要影響。

最近有消息稱,義大利政府準備出售 Enel 集團20%的股份,這些股份價值 78 億歐元。

作為歐盟電力排放大戶, Enel 在過去的三年中年均排放高達 6000 萬噸 CO2 。據初步統計, Enel 在《京都議定書》第一承諾期間( 2005-2012 年)每年須採購的 CO2 減排額將高達 500- 1500 萬噸。

(圖)義大利國家電力公司客人考察遠東

BUSINESS OVERVIEW

Enel is also the second-largest Italian distributor and vendor of natural gas, with over 2.3 million customers and a 12% market share. The company has 58,548 employees and operates a wide range of hydroelectric, thermoelectric, nuclear, geothermal, wind-power, and photovoltaic power stations.

In 2006, Enel posted revenues of 38.5 billion euros, EBITDA of 8 billion euros and net income of 3 billion euros. Enel was the first utility in the world to replace its Italian customers’ traditional electromechanical meters with modern electronic devices that make it possible to take meter readings in real time and manage contractual relationships remotely. This innovation has enabled Enel to implement time-of-use electricity charges, which offer customer savings for evening and weekend electricity use, an initiative that has attracted interest from many utilities in Italy and around the world.

INTERNATIONAL OPERATIONS

After having completed the sale of non strategic assets (property, telecommunications, water management ect.) Enel is actively engaged in international expansion in the power and gas market. With 19,000 MW in plants using renewable energy resources (hydro, geothermal, wind, solar and biomass) across the world, Enel is a world leader in the sector.

In December 2006, Enel launched a five-year plan (2007–2011) for the development of renewable energy sources and for research and development of new environmentally friendly technologies with an overall investment of 4.1 billion euros.

Enel is strongly focused on international growth and has a presence in Europe (Bulgaria, France, Greece, Italy, Romania, Slovakia and Spain), North America (Canada and the United States) and Latin America (Brazil, Chile, Costa Rica, El Salvador, Guatemala and Panama). With Endesa, Enel will also be present in Argentina, Colombia, Morocco, Peru and Portugal).

Enel runs operations in Spain in the generation, distribution and sale of electricity with the companies of the Viesgo Group, which has about 2,200 MW in installed capacity, and with Enel Union Fenosa Renovables, a company active in the wind and hydro power sector.

On 1 October 2007, Enel and partner Acciona successfully completed their Joint Tender Offer over Endesa. Enel and Acciona currently hold 92.06% of the share capital of Endesa (Enel 67.05%, Acciona 25.01%).

徠Enel is one of the largest renewable independent operators in the Americas with Enel North America and Enel Latin America, two companies that have about 1000 MW of installed capacity.

In North America Enel has over 400 MW of hydroelectric, wind and biomass power generation and has signed an agreement with the company TradeWind Energy in the US to develop over 1000 MW of new wind power.

In Latin America Enel operates over 600 MW of hydroelectric and wind power plants, including third companies operations in El Salvador and Panama respectively in the geothermal and hydroelectric fields.

In France, Enel has acquired Erelis, a company that has authorizations in several different fields to build wind plants of up to 500 MW. Over more, it has signed a Memorandum of Understanding with Edf to acquire 12.5% of the new nuclear power project European Pressurized Reactor (EPR). Enel owns 5% of the French power stock exchange Powernext and is one of the main operators in energy trading in the country with 1000 MW exchanged in 2006.

In Bulgaria, Enel acquired control of one of the country’s largest power plants, Maritza East 3, in March 2003. The lignite-fired facility has a capacity of 840 MW.

In Slovakia, in February 2005, Enel acquired 66% of Slovenské elektrárne (SE), the largest electricity generator in the country, and the second-largest in Central and Eastern Europe, with a generation capacity of 7000 MW, a mix of nuclear, thermal and hydro assets.

In Romania it acquired 51% of two electricity distribution companies in April 2005: Electrica Banat and Electrica Dobrogea, which supply 1.4 million customers. Further to the acquisition of Electrica Muntenia Sud, the company will double its presence in the Romanian power distribution sector, reaching about 2.5 million customers.

In Russia, Enel managed from June 2004 to September 2007– in partnership with the local private group ESN Energo – the North-West Thermal Power Plant in St. Petersburg. Enel has also acquired from the ESN Group 49.5% of RusEnergoSbyt, a Russian trader providing electricity to major industrial customers. On April 4, 2007, Enel acquired through SeverEnergia (formerly Enineftegaz, a consortium 40% Enel - 60% Eni) a group of promising gas fields including 100% of OAO Arcticgaz, 100% of ZAO Urengoil, 100% of OAO Neftegaztechnologia. Enel also holds a 37.15% stake in JCS Fifth Generation Company of the Wholesale Electricity Market (“OGK-5) is about to launch a public tender offer over the entire share capital of the group.

SHAREHOLDING STRUCTURE

The Italian Economy Ministry holds 21.1% of the company directly and another 10.1% indirectly through state-run lender Cassa Depositi e Prestiti, leaving a free-float of some 68.8%. Thanks to its Code of Ethics, Sustainability Report, its environmental protection policy and the adoption of international best practices for transparency and corporate governance, Enel’s shareholders include leading international investment funds, insurance companies and pension funds, ethical funds, along with Italian retail investors.

http://www.enel.it/

獲得榮譽 2020年12月17日。榮登2020世界品牌500強榜單,排名第444位。

2021年1月,榮登華祥苑·華茶·2020胡潤世界500強榜單,排名第117位。

2021年1月31日,榮登2021年全球最具價值500大品牌榜,排名第153位。

2021年8月2日,位列2021年《財富》世界500強排行榜第118位。